They lower earnings estimates for airlines of course.

What else do they have to do?

This morning analyst Kevin Crissey from UBS issued a research note in which he said, “The outlook for the US airline industry is changing very rapidly as fuel prices play an increasing role in painting the industry’s profit (well..loss) picture. As a result, our estimates have been getting stale quickly. In response we are moving to a periodic update schedule. We will be updating our forecasts at a minimum every two weeks to reflect changes in fuel and other factors.”

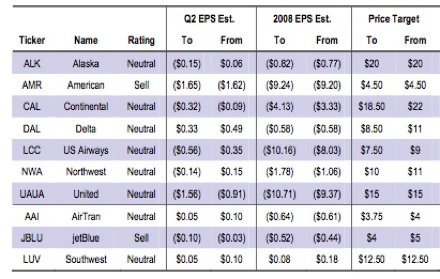

He continued, “There is little to like about the financials of the airlines right now. We forecast 2008 losses as large as $10/share (UAUA and LCC) and only LUV will be profitable if our numbers are correct. The extent and duration of the cash burn is the question rather than whether or not there will be profits. We have no Buy recommendations and have a Sell on AMR and JBLU.”

As for earnings revisions, Kevin noted, “We are updating our forecasts to reflect recent industry news, most of which has been negative. Our estimates now incorporate the 10-day moving average of forward fuel prices (~$3.40/gal) and include the unit revenue and traffic reports from the carriers. US Airways reported April passenger unit revenue (RASM) growth of flat to down two percent and jetBlue announced an April RASM increase of 3%. Both numbers are on tough comparisons given the shift of Easter to March this year but each also prompted us to slightly lower our Q2 revenue forecasts.”

My apologies for the fuzzy chart, but it was reproduced from a PDF and had to be “upsized” before converting it so you could read it.